Industrials Stocks

Top 50 stocks sorted by total investment ideas

The Boeing Company

Boeing Stock Rated as Hold Due to Overvaluation

"So, I've calculated a fair value for this business using my proprietary discounted cash flow valuation model of $161 per share. The current market price is $212 per share after the stock is down about 2% today. I see this business even after applying a margin of safety, I see this business being overvalued. On top of that, I've also decreased the company's beta by multiplying it by 0.85 because I see this business as being less risky than the beta suggests. Still, the stock looks overvalued and I'm not rating this business as a buy. In fact, to update my recommendation, I'm keeping Boeing stock rated as a hold."

FedEx Corporation

FedEx Earnings Beat with Tariff Headwinds

"Yeah, I want to start with FedEx, ticker FDX. Stock up just about 3% right now. This comes after the company reported earnings that were better than expected and the fact that it maintained its full year sales and profit outlook. The big question mark, though, has been the impact of tariffs. The company noting that they expect a $1 billion hit from trade volatility this year."

Power Solutions International, Inc.

Holding PSIX with a Long-Term Plan

"I got an email yesterday. I got several emails this week about stocks. One in particular asked me about PSIX. They said, "Hey, are you still in PSIX because I'm thinking of trimming it today." I wrote back, "Yes, I own it. I own it for a specific reason. I own it. I'm down on this one. I'm not up on this one. This one's at 83. They almost trimmed it yesterday. It's up 4%. This was at about 77 yesterday. And I hope that person didn't sell. I hope they still have it. And if they sold, I hope they journaled about this. Because it's a trade for me.""

Equifax Inc.

Equifax earnings strong despite negative CEO comment

"Now, moving on, we get to Equifax reporting their earnings this morning. The stock was down 4% because of some commentary of the CEO, despite the fact that they beat their estimates and raised guidance. I see the fundamentals moving in the right direction and will continue to hold for now. This is an example where a single statement can cause a temporary drop, but the underlying business remains fundamentally strong."

GE Vernova Inc.

GE Vernova: Reasonable Long-Term Buy on Profit Margin Expansion

"So it's not nearly as cheap as it was. Uh, yeah, to say the least. When we did the initial deep dive last June or July and called it out as a top energy grid, data center power idea. It was obviously mispriced after getting spun off of leftover GE Aerospace. So that cheapness is gone, but thanks to the profit margin expansion, the use of the net cash balance to make some key acquisitions and integrations in that electrification business, this still could be a reasonable buy for the long term. This is one we still like, especially for those of you that are still looking for big industrialist companies to incorporate into your portfolio. Looking for some way to invest in the power grid data center, power, all that good stuff. We still like GEV here."

General Electric Company

Long Trade on GE Aerospace Based on Strong Earnings and Momentum

"I didn't buy GE because it's cheap. I bought it because the quarter was strong, the setup was clean, and the riskreward was impressive. That's what I wait for. On Friday, I sent out a trade alert when I bought GE. Not because I'm guessing, because it showed up on my brand new post-earnings hottock list. And that list is fire. It filters for highquality businesses with monster quarters, clean technicals, and post-earnings bullishness. GE popped. I was ready. This wasn't a buy the dip play. It wasn't a hype spike. It was a slow, steady, post-earnings grind into a momentum squeeze backed by expanding margins and rising free cash flow. The kind of setup I absolutely love."

PACCAR Inc

Domestic Truck Maker Benefiting from Tariffs

"I also want to mention Paccar. It was topping in the S&P 500, the NASDAQ 100 here at the close, up about 5.2%. It's a truck maker and it rallied after the President Trump announced new industry specific tariffs that include a 25% levy on heavy trucks. And Alice say this company will benefit because it makes a lot of its trucks right here in the United States."

Corporación América Airports S.A.

Corporación América Airports S.A. (CAAP) - the local monopoly with unlimited power?

"Whoosh! An aeroplane takes off from the runway at Carrasco International Airport (MVD) in Montevideo, Uruguay, and you see all that happening from the viewing platform. You are heading back home from a holiday in Uruguay as a US-based investor. You really know for a fact that airlines have a tough t..."

Bloom Energy Corporation

Bloom Energy Profit-Taking Caution

"Bloom Energy, down 10% after five up sessions in a row, is showing signs of being overextended. It might be time for those who bought at the breakout to consider taking some profits."

Firefly Aerospace Inc.

Firefly Aerospace Faces Continued Setbacks

"Firefly Aerospace, the biggest downside mover, is trading down 10% in pre-market trade after yet another failed rocket launch following a similar mishap in April. The competitive satellite launch business, dominated by SpaceX, intensifies the challenge for Firefly."

American Battery Technology Company

Reliance Industries Advances Integrated Battery Energy Storage

"तो पहला एग्जांपल यहां पे Reliance Industries का है जो पीएलआई स्कीम के अंदर दे वन लाइक सम इंसेंटिव टू मैन्युफैक्चर लिथियम आयन सेल्स. ये पूरा का पूरा इंटीग्रेशन कर रहे हैं, पॉलीसिलिकॉन इनगॉट वेफर से लेकर सोलर मॉड्यूल्स और बैटरी वैल्यू चेन में बैटरी सेल, बैटरी पैक्स और बीएसएस तक. इससे Reliance green H2 प्रोडक्शन और ग्रीन एनर्जी ट्रांजिशन पर जोर दे रहा है, जिससे देश में फॉसिल फ्यूल डिपेंडेंस कम होगी."

CSX Corporation

CSX Shares Rally on Leadership Change and Deal Speculation

"Also looking at shares of CSX. This one though in the green up as much as 4.1%. This one also has no sell ratings here. Uh up for its biggest intraday gain since July in this year. And this is after the company named Steve an angel as its new CEO. This of course comes after the abrupt departure that we saw from Joe Henriches. This really overhauled the railroads leadership ... Bloomberg did report back in July that CSX is working with Goldman Sachs to explore options for a deal of its own."

Southwest Airlines Co.

Southwest Airlines Posts Surprise Profit Amid Policy Change

"Third name is Southwest, ticker LUV. So stock is rising more than 5% in postmarket trading. They posted a surprise adjusted profit. So at least we're ending on a good note. So, the good news was boosted by fees from its new policy of charging passengers for bags. Maybe it's not good news for us and expected record operating sales in the fourth quarter. So, the company earned 11 cents per share versus an estimated loss of 3 cents. I always just find it fun when the estimation is a loss and then you post a gain. So, the stock is up fractionally for the year through Wednesday close, but tomorrow it will probably see a pop."

NANO Nuclear Energy Inc.

Oaklo: Nano Reactor for AI Data Centers

"Yes, I think the big winner here, the lottery ticket here is Oaklo. Ok. Now, they're a nano reactor company, nuclear nano reactor. I think nuclear is the best energy for AI data centers cuz it's clean 24/7, very efficient, very cheap once built. So, I think it's the best. But big reactors take forever to build and we don't have forever. A big reactor takes 10 years. I just said by 2028 we're going to be 36 short. That's 3 years. We don't we can't wait 10 years for big reactors to come online. But a nano reactor, what Oaklo is building, they're about a tenth the size, maybe 12 to 24 months to going up and running from shoveling ground to actually producing energy, all of a sudden that makes a lot of sense."

United Parcel Service, Inc.

Buy UPS for Value/Durable Shipping Exposure

"I look at a name like UPS right now, which trades at 12 times earnings, pays a dividend. It's a company that I am certain is going to be around in 20 years. Shipping is not going away. UPS and FedEx basically have a duopoly right now. So I would much prefer to look at a name like that than to speculate at 50 times sales on NVIDIA or whatever."

Copart, Inc.

Copart: A Steady 'Hold' in a Niche Market

"Now, stock number three. This is an interesting one. Copart, guys, not a sexy stock, no AI, no social media buzz, just salvage cars. But let me tell you, Copart might be one of the quietest beasts in the market with a massive global buyer base, exclusive relationships with major insurers, and proprietary technology that streamlines its auction process. With very little debt, strong profit margins comparable to top players, and consistent free cash flow growth, our analysis shows the stock is currently at 44 with a low price range of 15 to 20, a high of 45 to 50, and a middle range of 26 to 35, leading the community to label it as a hold."

Comfort Systems USA, Inc.

Comfort Systems (FIX) Poised to Benefit from AI-Driven Construction

"For instance, this company called Comfort Systems, the symbol is FIX. They're in the air conditioning business, basically. But they're using AI to be more sophisticated about dispersing cooling."

Builders FirstSource, Inc.

First Brands Facing Potential Bankruptcy amid Debt Concerns

"One of the cracks is in First Brands, which is a car parts supplier. I've never heard of it either. But it's been feasting on private money from lenders and now it looks like it's heading into bankruptcy."

AAR Corp.

Trade Call: Buy AAR Corp Following Q1 Beat

"Well, ending on a green note on a good note here. AAR Corp. This is an aerospace and defense company in that sector there. It's about three billion dollars based in Illinois here, but it boosted its organic sales growth outlook after posting first quarter results that topped expectations. So coming out of those results that beat what the market was expecting here, it's saying, hey, we have a better outlook. Look ahead when we think about sales growth here for the company. A hundred percent of Wall Street is saying buy. That's according to the A&R page that we have here on the Bloomberg Terminal, about five analysts saying to buy the stock."

APi Group Corporation

Buy APG for Organic Growth and Attractive Free Cash Flow Outlook

"APG remains in our top five positions due to the runway for organic growth in M&A. I can conservatively underwrite a 15% to 25% return per year during the next three to five years, with APG having the ability to generate $1.3 billion in free cash flow by 2028 against a market cap of $14 billion."

ATI Inc.

Atai Life Sciences Buy Recommendation with Attractive Price Target

"There's a company I'm not familiar with, but it definitely was on the move today. The company is called Atai Life Sciences. The ticker is ATI. The stock jumped by 11% today. This is a clinical trial stage biopharmaceutical company. It came after a Republican state senator in North Carolina said that the state could "lead the nation in expanding military veterans access to mental health drugs" because this company specifically develops treatments for mental health diseases. And Nem initiated coverage of the company with a recommendation of buy and a price target of $12. Yeah. Not a company. Almost doubling today's price."

Axon Enterprise, Inc.

Axon Enterprise: Innovating in Law Enforcement Technology

"Axon Enterprise, formerly Taser, has transformed itself by integrating body cameras and cloud-based evidence management. There’s simply no clear competitor – no Pepsi to its Coke in the law enforcement technology space."

Delta Air Lines, Inc.

Company Commentary: Delta Airlines' Dominance in the Industry

"Delta is now 60% of the industry's profits. Kind of wild. They're killing it. I mean, they're by far the best airline. It's not even close, right?"

FTAI Aviation Ltd.

Why I bought FTAI Aviation

"Key information Ticker: Share price: $175 Investment type: Growth at reasonable price EV/EBITDA: 16x Estimated 2 year upside: 16% - 97% I recently took a 5% position in FTAI Aviation. Admittedly, I am late to the party on this one, and some people may be wondering why I bought near all-time highs. I..."

Honeywell International Inc.

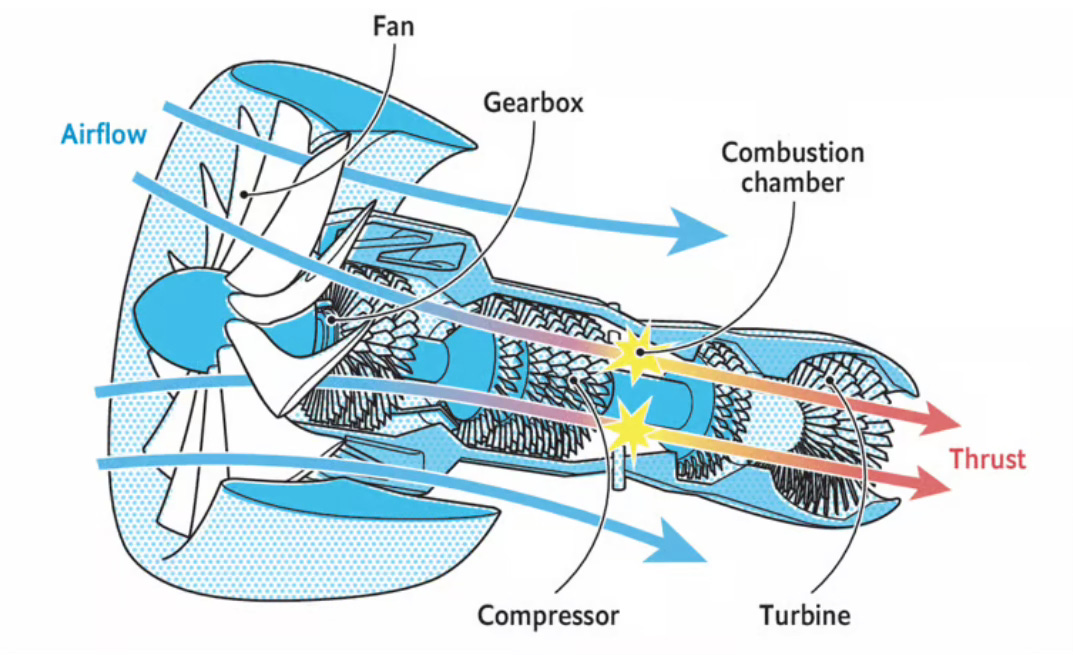

Honeywell Beats Earnings with Aerospace Momentum

"Well, this is telling us the key theme that aerospace commercial aerospace is doing very well this quarter. Honeywell up 4 and a.5% raised its fullear outlook and reported earnings that beat expectations boosted by the company\"s aerospace unit ahead of a planned breakup in the middle of next year. It plans to spin out its aerospace and automation business. Now this conglomerate houses aerospace building technologies, safety technologies and performance materials. But these results from Honeywell were really the latest to highlight the momentum for commercial aerospace manufacturers. We had positive news from GE Aerospace and RTX earlier this week. So really following along with the trend there. Now sales at Honeywell\"s aerospace unit jumped 15% in the most recent quarter."

Hertz Global Holdings, Inc.

Hertz Secures Funding to Ease Debt Concerns

"Hertz up 4.5%. They announced a $250 million senior note offering in a private placement that essentially will relieve them of a near-term debt crunch, and they will use that money to pay down their immediate debt obligations for 2025 and 2026. So it's looking better for Hertz's turnaround, but they still have a long way to go."

Howmet Aerospace Inc.

Company Commentary on HowMet Aerospace as a Leading Stock

"To wrap things up here, we mentioned that we were going to talk about an aerospace stock, Howmet Aerospace. It did have this cup base and had a good day today, up one and three quarters percent and right on the cusp of its previous high. What I love about this is that it's proven over a long period of time that it's a leading stock with strong relative strength on a long-term chart."

J.B. Hunt Transport Services, Inc.

JB Hunt Earnings Beat Drives Aftermarket Rally

"And I got to mention JB Hunt it's up like 12% here in the aftermarket and this is coming uh after the company reported their quarter earnings per share that beat the average analyst estimate."

Kimball Electronics, Inc.

AI Partnership Boosts Chipmakers

"Shares of Samsung Electronics, mine's two digits. You're getting there. Shares of Samsung Electronics and SK Hynix basically surge to multi-year highs. There's word that they partner with OpenAI as part of this big Stargate AI push. They’re going to focus on boosting the supply of advanced memory chips and expanding data centers. Samsung finished three and a half percent higher and SK Hynix jumped about 10%, boosting their combined market value by more than $30 billion."

Karman Holdings Inc.

Strong Buy Signal for Defense-Focused KRMN

"Carmen shares are up almost 9%. The company now has a strong buy rating and a street high price target of $100 from Raymond James, with the analyst suggesting that the business could triple by 2030."

Montrose Environmental Group, Inc.

Montrose Environmental Benefits from Lower Borrowing Costs

"Small-cap names do better in a rate cut environment, and I'm watching Montrose Environmental, ticker MEG. With roughly a billion-dollar market cap and a balance sheet showing 330 million in debt versus 11 million in cash, if borrowing rates come down, their consolidator strategy in a fragmented environmental services sector could pay off."

3M Company

3M Raises Profit Forecast Amid Turnaround

"Uh, let's do Post-it Maker 3M. Uh, huge portfolio of stuff. And I guess the conglomerate model that we've always talked about like you know GE maybe that's dead and buried but anyway the raising the profit forecast for the second straight quarter. The CEO there Bill Brown uh he's in the middle of a turnaround effort. Looks like it's kind of paying off. Uh the improved outlook suggests uh the alien company remains on track in the face of global tariffs and also unsteady demand for the company that we used to know in the market."

Quanta Services, Inc.

Trade Call on Quanta Services (PWR) Based on Base Formation

"Weve been talking about this heavy construction group ... providing construction, specialty contracting services, quanta services, right in the middle of this AI data center expansion. ... There is a flat base here. So the top of the base is obviously the official buy point. This was an early entry. This was our stock of the day."

QXO, Inc.

Buy QXO for Building a Consolidation Play in Building Products

"We sold some Tesla to buy QXO. We paid about $11 a share when QXO became tradable after Silver Sun Technologies was converted into a public company. With the stock now roughly double at $22 a share, and with a forecast to boost EBITDA from about $1 billion today to nearly $2 billion in three and a half years, the catalyst lies in harvesting operational synergies via the Beacon acquisition and redeploying free cash flow at an internal rate of return between 17% and 23%, with parts of the business targeting even higher returns in the 30% to 35% range."

RTX Corporation

RTX Upside On Earnings and Backlog

"Yeah, exactly. And we're also going to keep an eye on a stock of RTX trades under the ticker RTX, formerly known as Rathon, right now up 9.7% on pace to close at its own all-time high. The company is talking about their strength for earnings and a robust backlog as management called it. Revenues are better than analysts were expecting with notable upside for their jet engine division according to Vertical."

Serve Robotics Inc.

Trade Call on Serve Robotics

"The first stock we're looking at in today's video to add $100 into your portfolio is none other than Serve Robotics. Serve Robotics is a very strong company, a lot of potential going forward with the fact that they are going to have potentially a thousand robots in the fleet on the street and operating by the end of this year and it looks like they're going to achieve that goal. One thing I want to point out is Serve Robotics has also partnered with Door Dash. At the current price of $14.80, it's a pretty good buy. My AVP shows the stock is between $11 and $13.95, so basically, we're right at the top of my AVP. It seems like a smart opportunity to dollar cost average into this promising play."

NuScale Power Corporation

NewScale Power Benefits from Nuclear Trade Dialogue

"And new scale up about 14%. This is coming after news that Trump was going to use nuclear as part of kind of trade talks and coming after that meeting with the UK."

TIC Solutions, Inc.

Trade Call: Buy TIC (Acurin) on Low Valuation & Catalysts

"We had a report come out from our friend Satrini Research. The ticker is TIC. I think its Acurin, a UK SPAC now new to the U.S. market, offering non-destructive testing for industrial facilities. On a forward EBITDA multiple, its 8.5 compared to its peers, and with a merger with NV5 for data center infrastructure, the valuation looks very compelling."

Vertiv Holdings Co

Bullish Breakout Trade on Vertiv

"We had Vertiv on the leaderboard watch list for a period of time as it set up. And we moved it from the watch list to the leaders list in the model portfolio today on this beautiful, you know, breakout from a cup with handle base. And what's nice about this cup with handle, it's almost like a handle to this larger base."

Rocket Lab Corporation

Rocket Lab Setup with Key Support Levels

"Rocket Lab is in a good setup here. It has found support at the 21-day and 10-week lines fairly consistently, which is a positive sign even though this stock is known for its volatility."

United Airlines Holdings, Inc.

United Airlines Q3 Earnings Versus Market Reaction

"United Airlines down about 2% in the aftermarket that after uh it reported better than expected earnings for the third quarter and they expect brand loyal flyers in demand for its premium seats to drive profit through the end of the year and I think their outlook was pretty positive but investors don't seem so enthused."

Joby Aviation, Inc.

Short CLSQ and Joby Trade Calls

"Plenty of stocks still up a ton. Maybe I should short CLSQ. I'm short Joby as well."

Quanex Building Products Corporation

Netflix Under Pressure Over Tax Dispute

"Netflix can't skip that one. Ticker NX. We're seeing shares down the worst performing stock in the S&P 500 here. Down as much as 10% in trading. And this is the worst day since December 2022. This of course after the company said that a tax dispute with Brazil cut into its third quarter earnings. You're seeing a lot of people really digging into the details here. But that is definitely creating a drag here on the stock as you're seeing Wall Street really just trying to dissect what's going on here."

U-Haul Holding Company

Pass on U-Haul Despite Market Dominance

"U-Haul's just looked at as transporting stuff, but U-Haul is a pass for me."

L3Harris Technologies, Inc.

Lockheed Martin Corporation