Healthcare Stocks

Top 50 stocks sorted by total investment ideas

#1LLY

Eli Lilly and Company

$825.84

+0.59%

as of Oct 24, 2025

Ideas:10

Bull:8

Bear:0

Net:+8

Eli Lilly (LLY) as a Long-Term Add Amid Near-Term Headwinds

"And that's going to lead us to cheap stock number three, which is going to be Eli Lilly, stock ticker LLY. It is one of those healthcare stocks that has lagged the market, facing pricing and margin pressures, yet it presents a buying opportunity on the dip. Eli Lilly has a massive market cap of $757 billion, and over the past 12 months, shares are down 13%. Revenues have hit a record $53.3 billion with operating margins at 32.4%. With a forward PE of 26.4 times and an EV to EBITDA well below its 5-year average, analysts have given a 12-month price target of $947 per share, implying nearly 20% upside. Given the attractive PEG ratio and the company building its pipeline, it seems like a great time to add to the name."

— Mark Ren

Trade CallBullish

High Conviction#2PFE

Pfizer Inc.

$24.78

+0.38%

as of Oct 24, 2025

Ideas:8

Bull:8

Bear:0

Net:+8

Pfizer and TrumpRx: Navigating Pharma Tariff Pressures

"The final thing that was agreed in terms of drug prices with Pfizer was guaranteeing MFN prices for new drug launches. And the concept here was the administration said, look, we don't want you to agree a drug price with us and then go and undercut it when you go and launch in one of these next European countries."

— SPEAKER_05

Company CommentaryBullish

Medium Conviction#3UNH

UnitedHealth Group Incorporated

$362.60

+0.65%

as of Oct 24, 2025

Ideas:7

Bull:6

Bear:1

Net:+5

UNH: Opportunity in Insurance Through Call Spreads and Margin Recovery

"The final one, which is by far the most hated sector, is insurance, and the stock that I own is UNH, United Healthcare. Many of you asked, "What have you done on the dip?" and although I didnt buy the dip, I bought call spreads on UNH for June 2027, which are up about 74%. United Health fell significantly in 2025 due to underestimated medical costs, but they are addressing this by raising prices and exiting unprofitable plans. Their pricing strategy is intensely focused on margin recovery and moving back towards an earnings per share growth target of 13%. With strong cash reserves and a history of significant stock buybacks, I believe 2026 could be an amazing year for UNH."

Trade CallBullish

High Conviction#4NVO

Novo Nordisk A/S

$52.98

-0.45%

as of Oct 24, 2025

Ideas:7

Bull:4

Bear:3

Net:+1

Novo Nordisk Upgraded to Buy by HSBC; Catalysts on the Horizon

"Novo Nordisk got upgraded to a buy rating from HSBC. The analyst noted that Novo might be able to gradually turn a corner, with potential catalysts including its reimburse medical channel, direct to consumer channel, and the evoke trial for Alzheimers."

— Khloe Mele

Trade CallBullish

High Conviction#5ISRG

Intuitive Surgical, Inc.

$546.41

-0.90%

as of Oct 24, 2025

Ideas:5

Bull:5

Bear:0

Net:+5

Intuitive Surgical Outperformance

"I got to talk about ISRG. We're talking about in uh intuitive surgical, the maker of the Da Vinci surgical robot. Yeah, this one it is uh outperforming in a big way. I was just double checking because it is a top performer, number one gainer in the S&P 500 and NASDAQ 100. That stock as we speak right now is up about 14%. It was up as much as 19% intraday, but right now with a gain of more than 14%. Uh the company boosted its worldwide Da Vinci procedure growth forecast for the full year. It's all about that. So more people using that's a good thing for the company."

— Carol Master

Company CommentaryBullish

High Conviction#6TLRY

Tilray Brands, Inc.

$1.48

-0.67%

as of Oct 24, 2025

Ideas:5

Bull:5

Bear:0

Net:+5

Imperial Brands Buys Back Shares and Delivers on New Generation Growth

"Imperial Brands is another top performer in Europe. It is on track to meet its full targets thanks to growth in both tobacco and new generation products, and it recently announced a new buyback of 1.45 billion pounds. The new CEO, who started on October 1st, now faces the challenge of executing a five-year strategy to 2030, which focuses on continuing cigarette growth while scaling new generation products and creating a more efficient organization."

— Chloe Malay

Company CommentaryBullish

Medium Conviction#7MOH

Molina Healthcare, Inc.

$163.38

+1.34%

as of Oct 24, 2025

Ideas:4

Bull:3

Bear:0

Net:+3

Strong Insider Alignment Through CEO Compensation Structure

"if he sticks around through 2027 and the company achieves $36 of EPS, he gets another 150,000 shares."

— Steve Gorelik

Company CommentaryBullish

Medium Conviction#8AZN

AstraZeneca PLC

$83.28

-0.13%

as of Oct 24, 2025

Ideas:4

Bull:2

Bear:1

Net:+1

Astroenica Deal Brings Cautious Relief Amid Uncertainty

"So there was news after market close late on Friday that Astroenica, the farmer giant listed in London, had made a deal with the Trump administration to lower some of their prices on drugs in the US in exchange for relief on tariffs for 3 years. So obviously this came after the market close on Friday. Initially, shares were up and analysts were saying this will likely provide some relief, showing a willingness from the US to preserve sector fundamentals. However, shares are now trading slightly lower and there\"s a lot of uncertainty, given the lingering issues related to tariffs and pricing pressures. We\"ll be keeping an eye on their share price through the day."

— Louise Moon

Company CommentaryNeutral/Mixed

Medium Conviction#9MNKD

MannKind Corporation

$5.30

-3.19%

as of Oct 24, 2025

Ideas:2

Bull:2

Bear:0

Net:+2

Strategic Acquisition of SC Pharma and Revenue Diversification

"Yeah, you know, I think you hit the nail on the head. Like we, we want to keep building this company, growing a great company, having a great culture. Um we'll have offices in Connecticut, Boston now, and here in California. Um, one of the things we have to do is diversify our revenue streams, right? You come to a quarterly earnings and two thirds of your revenues are from United Therapeutics. And until our pipeline hits, which will start happening pretty quickly now, we were stuck at their mercy. We were looking for an active revenue stream that we could add value to and was already product approved. SC Pharma popped up, and they were short on cash and capabilities. We believe that combining what we built on Fresza with what they have, where we go with our strategy, is going to turn one plus one into three or four."

— Mike Castana

Company CommentaryBullish

High Conviction#10GSK

GSK plc

$43.24

-6.83%

as of Oct 24, 2025

Ideas:2

Bull:1

Bear:1

Net:0

GSK Faces Sales Concerns Despite Regulatory Approval

"So when you first look at it, seems like positive news. So US regulators have approved GSK's blood cancer drug that's called Blendre. So they can obviously now bring that medicine to the US, which is the world's biggest pharmaceutical market that they had pulled the drug in 2022. There were questions about how effective it was, but now they can now bring that back to the market. But as you say, shares are dropping. They're dragging the Footsie 100 this morning in London. This is because despite being approved there are a lot of caveats that have come with that approval. The eligibility pool of who can use it is smaller than expected."

— Louise Moon

Company CommentaryBearish

Medium Conviction#11ABVX

ABIVAX Société Anonyme

$90.83

+0.38%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Bullish Call on ABVX with Target Price of 200

"Yeah, one stock I like. Come on, man. Come on. I like a stock called ABVX. I've been long, I've been longing the stock. I think it's going to go to 200. And that's really it. It's a drug company and I believe there’s substantial upside."

— Speaker 1

Trade CallBullish

High Conviction#12DRTS

Alpha Tau Medical Ltd.

$4.22

+0.48%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

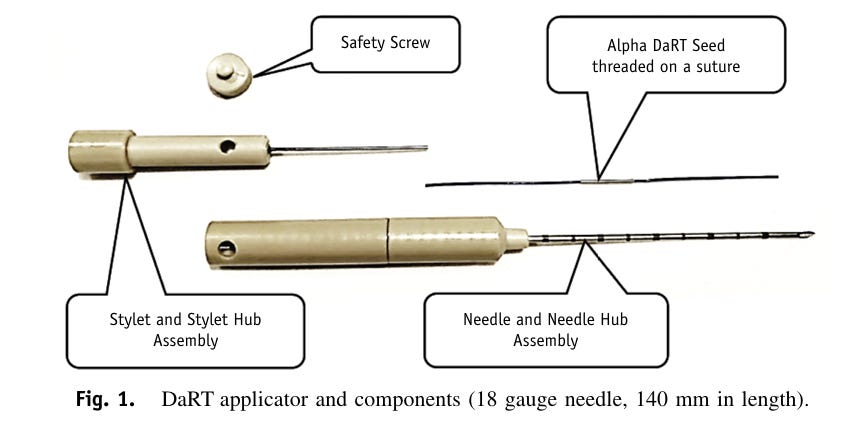

Alpha Tau Medical: Localized Alpha Radiation, a New Paradigm in Oncology

"(For smaller updates, commentary on news, positioning, etc., follow my X/Twitter ) Intro Alpha Tau Medical (DRTS) is pioneering the first and (as far as we are aware) only way of delivering alpha particle radiation locally to solid tumors. While the company is not currently well known, this represen..."

Trade CallBullish

Medium Conviction#13ETNB

89bio, Inc.

$14.79

-0.10%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Biotech Momentum in 89 Bio Amid Roche Acquisition Talk

"I want to mention a company we don't talk about it, 89 Bio, tickers ETNB. This stock up 85% in today's session... Roche, and this kind of plays into this whole subject and area of weight loss drugs. Roche said it will acquire this biopharmaceutical company for up to $3.5 billion."

— Team Commentary

Company CommentaryBullish

High Conviction#14HNGE

Hinge Health, Inc.

$49.50

+0.12%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Hinge Health Breakout Actionable Setup

"I bought it off the 21-day line a couple of days ago. But there's a trend line from the top of the handle and the base, which makes this breakout scenario interesting."

— Ed Carson

Company CommentaryBullish

Medium Conviction#15IRTC

iRhythm Technologies, Inc.

$180.78

-0.84%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Buy Call on iRhythm Technologies (IRTC) Based on Innovative Cardiac Monitoring

"iRhythm is a 5 billion market cap company that does cardiac monitoring. The combination of product innovation, clinical outcomes and FDA compliance has positioned them for growth in the high teens, low 20s over the next couple of years. We are pretty excited about this company and it could be a buyout candidate."

— Greg Torto

Trade CallBullish

High Conviction#16MRK

Merck & Co., Inc.

$87.49

+0.34%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Merck: Long-Term Value Amid Patent Headwinds

"My pick today is Merck... it is one of the cheapest now among all the big pharmas... holding this stock for the next five years will help us earn the dividends of 4% while potentially delivering a 15% internal rate of return."

— Hari Rama

Trade CallBullish

High Conviction#17OMI

Owens & Minor, Inc.

$5.52

+5.14%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

DV Capital | Owens & Minor | Deep Dive

"Owens & Minor is dumping its low-margin business, going lean, and setting up for a massive run investors aren’t ready for."

Trade CallBullish

Medium Conviction#18QURE

uniQure N.V.

$61.01

+2.95%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Company Commentary: UniQure (QURE) Delivers Home Run Data Readout

"They had a 75% disease progression reduction reading and if you hit 75% and above, it's a home run. The data is unequivocal and supports a blockbuster approval scenario for the first ever gene therapy for Huntington's."

— Speaker

Company CommentaryBullish

High Conviction#19SPRB

Spruce Biosciences, Inc.

$131.15

+0.88%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Long SPRB on Rare Disease Catalyst

"Why long SPRB? Well, this is my wheelhouse. Its a rare disease drug company and they have a rare disease from a drug from Biomearin. Biomearin was kind of like the rare disease kings and, um, yeah, basically, um, the drug works, um, really well and, um, itll get FDA approval and itll sell a lot and thats really it. Its worth like 5x what its trading at."

Trade CallBullish

High Conviction#20TEM

Tempus AI, Inc.

$89.23

+2.54%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Tempest AI: Disrupting Healthcare with AI

"Yeah, so the company that I like the most in the application layer right now is Tempest AI, tickers TEM. Um, we like Palanteer for a very, very long time, but that was one that I think it is now really big. You know, Nebus and Oaklo, they're still pretty small. Palanteer is actually really big now. We still like it. I think it's a long-term winner, but I don't think it has that 5x, 6x, 7x high torque upside. Tempest AI to me does. I think healthcare AI is the last undervalued and undiscovered corner of the AI boom, and those stocks are starting to wake up. There's a few names in there that have really gone on big rallies over the last few weeks, and the one leading the charge that has the most upside potential in our opinion is Tempest AI. I think they have a really good team. They're creating personalized health care solutions using AI."

— Luke Lango

Trade CallBullish

High Conviction#21TOI

The Oncology Institute, Inc.

$4.75

+2.81%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

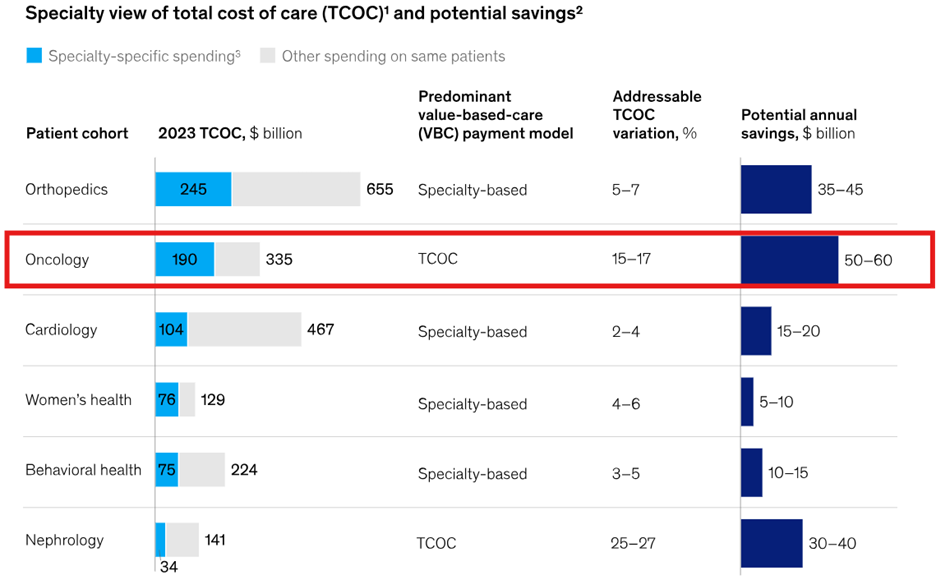

The Oncology Institute (TOI). Second part

"I’ve previously covered The Oncology Institute (TOI) here . This post dives deeper into the seismic shift toward value-based care in the U.S. healthcare system and why TOI is uniquely positioned to lead in the oncology sector. With profitability on the cusp and a vast growth runway ahead, TOI ..."

Trade CallBullish

Medium Conviction#22WRBY

Warby Parker Inc.

$21.25

-4.11%

as of Oct 24, 2025

Ideas:1

Bull:1

Bear:0

Net:+1

Warby Parker Disrupts Traditional Eyewear With Omni-Channel Model

"My supernova stock idea is Warby Parker, which you may know as the company that started selling eyewear online and has since moved on to building out about 250 stores around the U.S. in several U.S. states... And I own these shares. I've been buying. I really like this company."

— SPEAKER_04

Trade CallBullish

Medium Conviction#23ABBV

AbbVie Inc.

$228.06

-0.08%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:0

Net:0

AbbVie Successfully Navigated the Humira Cliff but Faces Future Risks

"Abbvie has proven that it can successfully navigate a difficult patent cliff. Humira wasn't just Abbvie's top-selling drug for years. But Abbvie was able to significantly reduce its dependence on Humira, even before it lost US patent exclusivity in 2023 through some key acquisitions, the company developed two successors to Humira that will together generate more revenue this year than Humira did at its peak. The main reason I didn't give Abbvie an even higher score is just the intrinsic risk that's associated with developing new drugs, and there's potential negative impact of tariffs on pharmaceutical imports to the US if the Trump administration goes ahead with that."

— Keith Speights

Company CommentaryNeutral/Mixed

Medium Conviction#24GEHC

GE HealthCare Technologies Inc.

$78.17

+1.18%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:0

Net:0

GE Healthcare Not Compelling for Watch List Inclusion

"GE Healthcare is a leader in the medical technology industry. I think that aging demographics and the opportunity for AI to revolutionize medical imaging present great long term tailwinds for the company. However, GE Healthcare does face some strong competition, has some challenges in China, especially, and it could experience some more headwinds from tariffs. The stock has underperformed the S&P 500 badly since that spin off from GE a few years ago. They've given GE Healthcare an all right overall score of 6.7 out of 10 and it wasn't compelling enough for me to add it to my 100 stock watch list."

— Anand Chokkavelu

Company CommentaryNeutral/Mixed

Medium Conviction#25HOLX

Hologic, Inc.

$74.00

+0.19%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:0

Net:0

Hologic Leveraged Buyout Announcement

"This is the medical device maker based up I think it's Marbor Massachusetts anyway and all that. So we've been reporting for the better part of a year there's interest Blackstone and TPG uh they were interested in Hologic. We first said that back in May. Uh and back then the approach was rebuffed. Well last month they had re-engaged. At least that's what our reporting and now yeah it's official. Blackstone TPG. They're going to pay uh $79 up to $79 a share uh for Hogic. And uh yeah, classic leveraged buyout here."

— John Tucker

Company CommentaryNeutral/Mixed

Medium Conviction#26ATOS

Atossa Therapeutics, Inc.

$0.93

+1.76%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:1

Net:-1

Company Commentary on Atos Revenue Miss and Restructuring

"At Atos, the French IT company, shares were down initially about 17% after their third quarter revenue missed estimates. They lowered their revenue guidance for the year, citing a soft market environment, loss-making contracts, and macro uncertainty. Although there were some positive signs with recovery in North America and Europe, these were not enough to offset the negatives. Analysts mentioned that declining revenues are expected to continue through 2025, with 2026 projected to be the pivotal year of recovery."

— Louise Moon

Company CommentaryBearish

Medium Conviction#27CON

Concentra Group Holdings Parent, Inc.

$20.93

+1.70%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:1

Net:-1

Continental Spinoff Triggers Sharp Stock Decline

"So Continental is Continental's first day of trading after the spinoff of its Omovio business, which is the parts supplier business. And it was spinned off today on the Frankfurt Stock Exchange. As expected with a spinoff like this, the shares do drop massively. Now the market will really start focusing on what the opportunities and the challenges are for those two separate companies."

— Jamana Bissechi

Company CommentaryBearish

Medium Conviction#28MLTX

MoonLake Immunotherapeutics

$9.52

+0.63%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:1

Net:-1

Avoid Long Position in MLTX

"MLTX big disappointment 88%. We didn't have the confidence uh either way of position like most of the street. I was thinking it maybe was long. It was not a long."

— Host

Trade CallBearish

High Conviction#29NVS

Novartis AG

$130.39

-0.95%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:1

Net:-1

Goldman Sachs Sell Call on Novartis Amid Rising Generic Competition

"Goldman Sachs cut Novartis to sell today. They basically said that the last few years, Novartis has been on a good run, but over the next couple of years structural shifts and increased generic competition could drag down its growth."

— Sam Unstead

Market ContextBearish

High Conviction#30SGMT

Sagimet Biosciences Inc.

$9.14

+24.35%

as of Oct 24, 2025

Ideas:1

Bull:0

Bear:1

Net:-1

SGMT Caution - Avoid Trade Call

"SGMT is a no. If you got in below $11, take profit and then SGMT is a no."

— Host

Trade CallBearish

High Conviction#31CNC

Centene Corporation

$36.09

+1.38%

as of Oct 21, 2025

Ideas:0

Bull:0

Bear:0

Net:0

#32IONS

Ionis Pharmaceuticals, Inc.

$71.65

-2.57%

as of Oct 21, 2025

Ideas:0

Bull:0

Bear:0

Net:0

#33JNJ

Johnson & Johnson

$190.36

-1.08%

as of Oct 24, 2025

Ideas:0

Bull:0

Bear:0

Net:0

#34UTHR

United Therapeutics Corporation

$422.78

-2.26%

as of Oct 21, 2025

Ideas:0

Bull:0

Bear:0

Net:0