Sell Put Option Trade Call on META

"Next trade is going to be Meta. Meta specifically, guys, is a very good stock because it has come down a lot from its high following a big earnings surprise. I'm going to be selling a put option because I am 99% sure that the strike at 593 represents a massive discount and solid value for Meta. That's exactly the safe put option I'm going to sell right now, as I aim to get into Meta at around 600 per share."

The trader is selling a put option on Meta (META) after observing a significant decline from its highs post-earnings miss. He expresses high conviction in the valuation, stating that the 593 strike is a compelling discount point to potentially acquire Meta at around 600.

Meta Platforms: Undervalued with a Clear AI Monetization Path

"Another stock that's trading well under its fair value is Meta Platforms. According to DCF models, Meta Stock is 23% undervalued, which means it has a 30% upside from its current price, even though it's one of the biggest money printers on the planet. Meta is selling off mainly because investors are nervous about its AI and infrastructure spending that it's gotten so big that it could hurt their near-term earnings and free cash flows, just like they did with the metaverse in 2022. In their most recent earnings call, Metaguided their 2025 capex budget up to 70 billion. That's versus around 40 billion in 2024, and they warned that their AI spending in 2026 will be even higher. Wall Street is worried that Meta Platforms won't be able to make money on their AI investments for years to come, just like Oracle. But Meta is nothing like Oracle. Meta is already monetizing AI today, mainly through better ad targeting, automated tools, and AI-driven shopping."

The speaker discusses Meta Platforms as an undervalued opportunity with an estimated 30% upside based on DCF models. Despite market concerns over high AI and capex spending, Meta is already successfully monetizing its AI capabilities, especially in advertising, which makes it a promising long-term investment.

Initiating a New Position in Meta as a Value Entry

"Meta is a stock that I owned in my portfolio a while ago, and while I exited my previous position with a great gain, I now see the risk-reward as pretty impressive when the stock is trading lower. After seeing it continue to fall below 600 per share, I've taken on a small initial position because I believe the accelerated revenue growth and the results from their capex investments are already starting to pay off. If the share price remains down, I'll continue to nibble on it and build a larger position over time."

The speaker explains his decision to initiate a new, small position in Meta, citing the stock's attractive valuation after a significant sell-off and strong underlying business performance driven by accelerated revenue growth and beneficial capex. He plans to add to his position if the price remains low.

Meta Buying Opportunity Amid Dip

"I'm with you 100%. Um, Meta is a buy. In fact, I when I saw it drop 15%. I bought it. Now it's down 23. I might have to add some shares to the portfolio. Again, I like the aggressiveness of Zuckerberg. Their capex spend, you know, they said they're increasing it. They're all in on this, and they understand the severity of winning this AI race. They have the innovation and the data, and with all the platforms at their disposal, they have products now."

The speaker recommends buying Meta (META) after a 15% dip, emphasizing its strong turnaround, aggressive capital spending, and robust positioning in the AI race as reasons to consider accumulating additional shares.

Meta Undervalued Buying Opportunity

"Looking at Meta, it has been beat up. The only reason why Meta missed 84% on this earnings is because of the tax hit that they opted to take at a discounted rate. You make a lot of money, you pay a lot of taxes. When you look at this, one thing we know about a a good company, Meta is a good company. And one thing we know is that when a company is beat up really, really bad is the time to buy it. Right now is a buying opportunity. Tom Lee has said it. Everyone has said this about Meta. Now is a buying opportunity. Bouncing on the 609 range on this chart and 631 a lot. It's been bouncing right here at the top of 609 and 600."

Meta has been heavily beaten down due to a discounted tax hit on its earnings, presenting a compelling buying opportunity according to the speaker. He highlights that strong companies like Meta, when severely undervalued, offer robust support levels (around 609-631), suggesting a rebound potential.

Buy Opportunity in Meta at Lower Prices

"Now, the first stocks that I'm looking to buy over the next 30 days is Meta. Meta is down 14% on the months. I did a video on it at 650, but I told you guys if the AI fears continue, it could potentially go to 550. And it seems like it's on its way there. And I personally like it."

The speaker explicitly identifies Meta (META) as a buy within the next 30 days, highlighting its 14% decline over the month and mentioning a potential drop to 550 if AI fears persist, emphasizing the stock's undervaluation relative to its growth prospects.

Meta Platforms: DCF Valuation

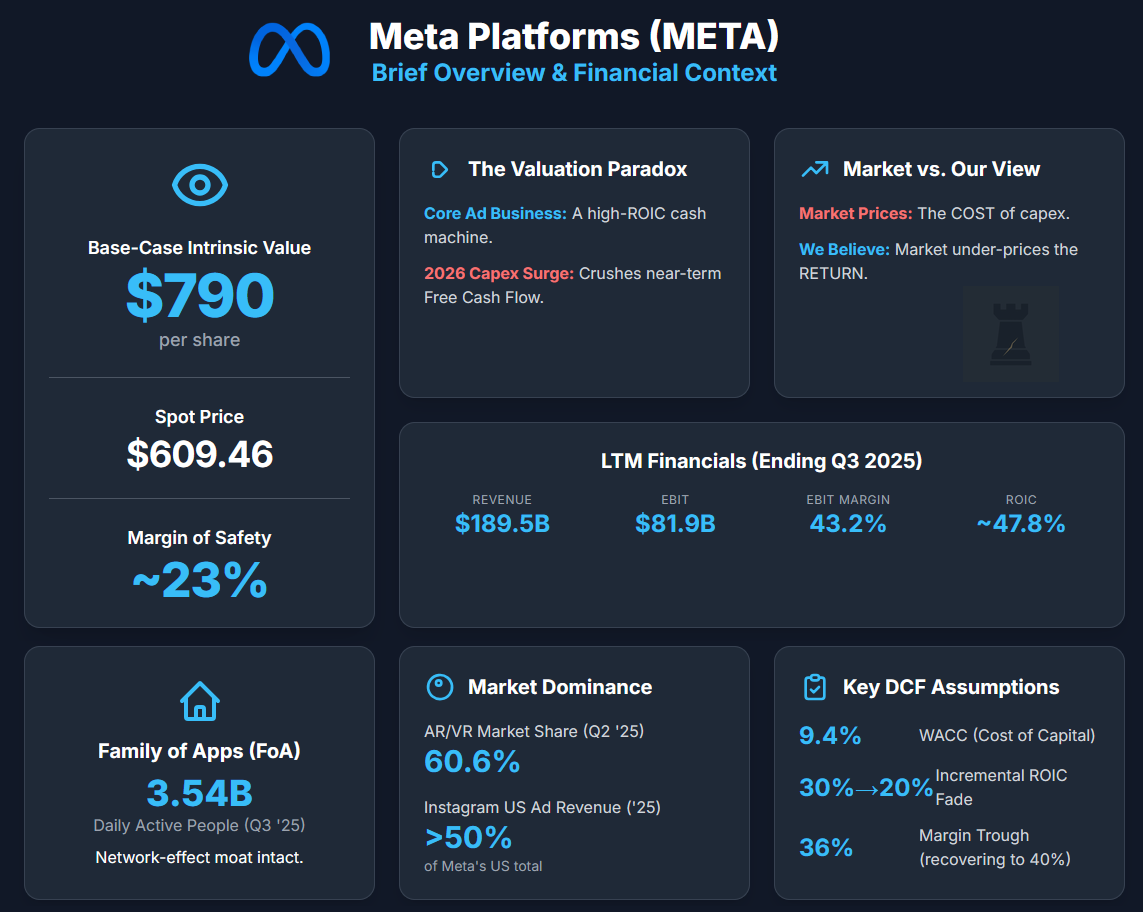

"Brief Overview Meta Platforms (META) is a valuation paradox. FoA’s (Family of Apps) network-effect moat remains intact, and the capex wave is best seen as an aggressive, front-loaded reinvestment into that franchise rather than a blind bet on the metaverse. On that basis, META screens as undervalued. Business & Financial Context Meta Platforms reports two segments."

Date of Analysis: November 12-14, 2025 Verdict: Undervalued Current Price Target (Base Case): $790 Price at the Time of Analysing: $609.46 1. Brief Overview Meta Platforms (META) is a valuation paradox. The core ad business remains a high-ROIC cash machine, yet management has guided to an unprecedented AI and data-centre capex surge in 2026 that will crush free cash flow in the near term. The market has punished the stock accordingly, but we believe it is now over-discounting the pain. FoA’

Meta: Entry on Best Ideas List Amid Dip

"Stephanie Link, I love her. Totally agree with my friend Dan Ies. I'm putting Meta on the best ideas list. Stock down 19% in two weeks now trading at 19 times earnings per share. Cheapest of the Mag 7 with 25% TRD growth, 40% OM with AI monetization, 14% impression growth, PX ad 10%. Go and ask what AI does mean what that means. I have no idea. But she is a fundamental genius and she's telling you it's cheap and it was cheap back here of 521 when I loaded in. Did I start trimming this? No. I bought more at 660. My journal said be more patient. I was more patient. I said, 'Wait for it.' You can see I got an alert right there at 624. Did I buy? No. I didn't have confirmation. It's about the risk and reward. I want to see where this one starts to bounce back up."

The speaker highlights Meta as a top pick, noting that the stock has declined 19% over two weeks and is trading at 19 times earnings. The commentary praises the fundamentals, citing growth metrics and attractive valuation, while emphasizing a patient approach to buying on dips based on risk and reward analysis.

Roll Sell Put on Meta to Lower Assignment Risk

"Meta, I sold this $700 put. Meta is currently trading for $68 per share. So, what I can do is I can move this position lower. And the reason why I would want to do that is because I wouldn't be forced to buy Meta at 700. I can buy it for less. Basically, I'm going from 700 down to 690 to reduce my risk and allow extra time for Meta to recover."

The speaker explains an options roll strategy on Meta where he lowers the strike price from 700 to 690 to reduce the risk of assignment. He highlights that by rolling the sell put and adding more time (targeting a February expiration), he positions himself to benefit from a potential recovery in Meta's price while collecting a credit.

Buy Call on Meta Platforms Based on DCF Undervaluation

"Meta Platforms, I calculated its intrinsic value per share at $853 and the current market price is $623. So according to my proprietary DCF model, Meta Platforms looks significantly undervalued. Its weighted average cost of capital is 10.77% and its ROIC tow ratio is also close to 3:1 but it's less than the ROIC tow ratio for Alphabet because Alphabet has a slightly lower weighted average cost of capital. I still like both of these companies. I think they'll make great long-term investments. But if you're forced to pick one, I think Meta Platforms is the better value right now."

The speaker compares Meta Platforms and Alphabet using a proprietary DCF model and other key metrics. Despite both being strong long-term investments, he highlights that Meta Platforms is significantly undervalued compared to its current market price, making it the preferred buy call at this moment.