Professional Trader is Long on these 2 Stocks

January 12, 2026

Kyle Vallans

Overnight Momentum Trader, Founder of SaveOnTrading.com

Top Holdings: $VTI, $TTD, $BULL

Hello! Who are you and what's your background?

Hi, my name is Kyle Vallans and I am a professional trader of 8 years. I spent a number of those years trading at a well known proprietary trading firm, SMB Capital/Kershner Trading Group. I spent a couple years at the NY office (SMB Capital) and then went over to our Austin Office (Kershner Trading Group) and spent a couple of years there. During this time, I developed my trading.

In 2024, I decided to step away as I wanted to move away from handling the firm's money, to handling my own money in markets and pursue some other passions as well. I still actively trade today and am hitting new strides in markets, but I also work for a fintech company that many people probably know and use in their day-to-day trading and investing.

I launched SaveOnTrading.com in June of 2025 which is an online marketplace that gets you the best prices on top trading tools and services. Right now, we have a little over 30 tools on our site getting you the best prices, but the goal is to cover them all with time. Many of the discounts are through exclusive partnerships that we have worked out, and when that isn't possible, we just get you the best price that is currently online. Whenever a holiday sale comes around that beats our pricing, we change the pricing to meet the sale. Traders buy through us because they know they are getting the best price. And companies work with us because we do a lot of marketing for them through blogs, newsletters, YouTube, socials, and a couple Discord servers. We drive many thousands of clicks per month to our partners, and save people quite a bit of money. I am passionate about this because I love fintech, I love helping companies, and I love saving people money.

I am very passionate about markets, technology, small business ownership, and far too many sports and hobbies. I got into CrossFit in 2025 and got into decent shape as a result. You can find me working at home, or at a local coffee shop most days, and then working out a couple hours each day in the evening.

SaveOnTrading.com

How would you describe your investing style today?

I focus all of my attention on overnight momentum trading and higher time-frame mean reversion trading.

Overnight momentum trading is taking out strong stocks on the close overnight in anticipation of a gap up in which I can sell into. Likewise, on the short side, I look to take weak stocks short overnight in anticipation of a gap down. There's a lot of nuance to it, but that is the general essence of it.

I am a slow and deep thinker so I focus on strategies that mesh with that.

In a momentum rich environment like 2020, 2021, 2024 and 2025, it works incredibly well. In a dull market like 2022 and right now (2026), this style of trading doesn't work well so you need to avoid it.

I also focus on higher time-frame mean reversion setups. In essence, it is when a stock gets incredibly steep over a number of weeks, months, or years, and I look to take the other side of the move for a reversal. There are a bunch of different permutations when it comes to this, but my favorite amongst them all is when I get to buy great companies at great prices usually as a result of short-term negative news.

Walk us through your process from finding an opportunity to exiting a position.

When it comes to overnight momentum trading, they purely come from three filters I look at into the close. One is for overnight momentum on the long side for mid/large caps, one is for overnight momentum on the long side for small caps, and one is for overnight momentum on the short side. I use custom built filters that I built into Trade Ideas, but essentially, it's stocks closing in the top 20% of their intraday range on huge volume. On the short side, it's just flipped: stocks closing in the bottom 20% of their intraday range. I look at these scans the last 20 minutes of the day, decide whether we are in an overnight long market, an overnight short market, or a no overnight tape and then I figure out why each stock is on the list, what the news is, what the dilution risk is, review prior overnight performance of each stock, and probably think through 20-30 different things that are important before deciding whether or not to take it, how much to risk, and what I think the upside and probability might be.

When it comes to higher time-frame mean reversion trading, these are hard to miss. They are stocks that are getting smoked and or are up a lot in which everyone is talking about them, even non traders and CNBC. I have a few filters for this style of trading that I built into Stock Analysis, but there's just a lot of nuance to each so the detail is a bit harder.

Asymmetry is incredibly important to me. In simple terms, I want to make sure I am going to make a lot without risking nearly as much, and that the win rate is very very good. Overnight momentum tends to have a lower win rate, but it is more frequent whereas higher time-frame mean reversion trading tends to have a really high win rate, high payout, and the risk isn't all that great if I time things properly. But, the frequency of higher time-frame mean reversion trading in good markets is maybe 2-4 a quarter and in slower markets, maybe 1-2 (if that) so you want to make them really count.

Deal breakers are potential opportunities in areas I'm not good in or that I don't understand. I am happy with my style of trading and performance, and I have been through the gauntlet of trying a bunch of stuff out, and this is where I landed.

I want to bet a lot when something is very asymmetrical and that I have a lot of confidence in. I don't use much leverage nowadays, which allows me to not need to time everything so perfectly when it comes to overextension trading. Sometimes I am a day early, and that's usually okay. When something isn't an absolute home run style of idea, I rather just not trade it if possible. This has me doing far less which I prefer.

When it comes to trades that are working, usually the faster the move, the faster I want to be with exits. The more grindy action, the more mechanical I want to be and slower with exits. Identifying what style of trade I'm in is very important. For overnight momentum trading, I am usually just in for 1 overnight session and I am looking to sell the gap up/gap down. Whereas big overextension trading, I want to be patient and often hold for weeks or months, and usually should be holding for years/ever. These are usually the highs/lows of that stock and are great prices to be involved in.

What are the biggest opportunities you see in the market today?

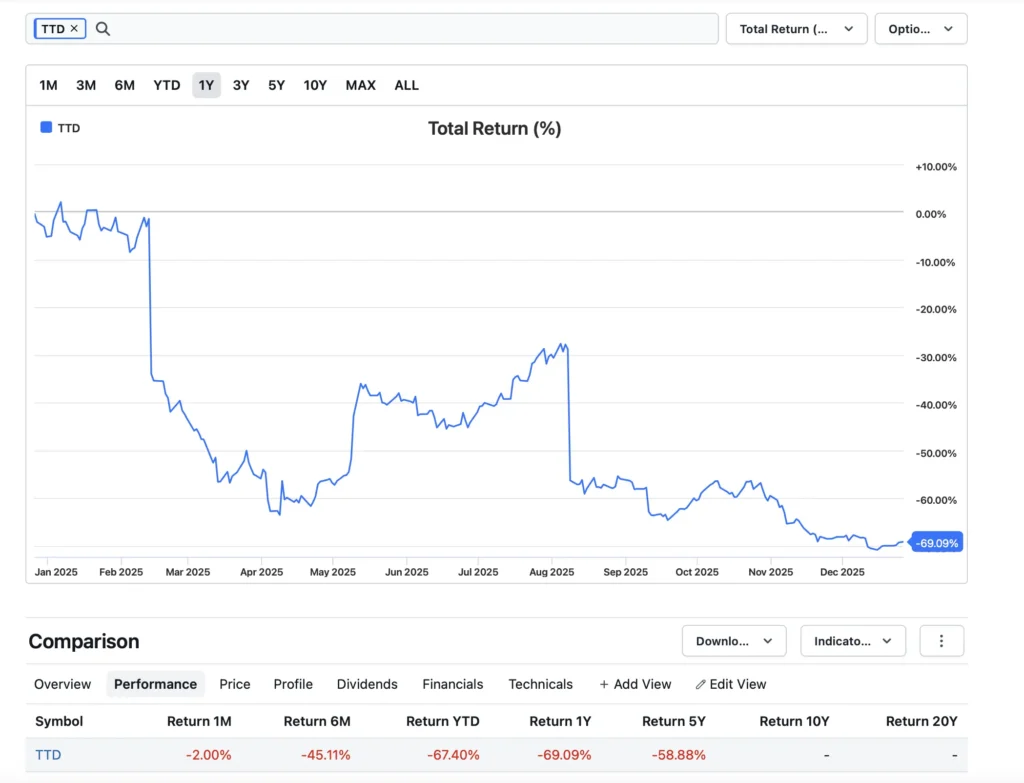

- Being long The Trade Desk ($TTD). When good companies that get hit hard are still growing revenue and have a lot of cash on hand, it provides a bit of a safety blanket. These companies can reinvest into research and development, spend more on advertising, buy back stock, issue a special dividend, and generally have a lot of levers they can pull. So being long The Trade Desk, which is down 69% over the last year, still growing its revenue, has a bunch of enterprise customers, and holds a lot of cash on the balance sheet, seems like a good bet to me. I am long The Trade Desk from $38.01 and would love to hold this stock for the next year plus. Read the full thesis: Why I Bought The Trade Desk (TTD) Stock After a 69% Drop.

$TTD Chart

- Being long Webull ($BULL). I see a potential floor around $3-$4 in an absolute worst-case scenario. I like being long from $7.90 and think there's a meaningful asymmetric upside from here. If the stock were to leak lower without the story changing materially, I'd actually like it even more. Read the full thesis: Why I Bought $BULL on the First Trading Day of 2026.

- Being short CVNA. Post S&P 500 and way overcooked. I am not involved in this yet.

How are you thinking about the market right now?

No overnight momentum trading, or any momentum strategies for that matter.

Trying to focus on companies that have gotten hit very very hard over the last few months/years that have a ton of cash and little debt, and can weather the storm. And, staying open minded to bigger picture shorts, such as maybe getting short CVNA. Actively trading this market in 2026 in a momentum style fashion will likely lead to awful results. Feels a little 2022-esque in which we either get smoked, or a lot of choppy action.

Also, all this gambling in stupid crap like Bitcoin and crypto is going to end so badly. Crypto is very stupid, and has no intrinsic value. To me, it's all a zero. Maybe Bitcoin is back to 5-10k in a couple years or so and we all look back at how silly everyone was being.

Also, prediction market sites make no sense. There is no way to stop the insider trading that takes place so once we get a non kook president, these prediction markets will probably be removed.

Finally, you should not use brokerages like Robinhood that allow for gambling on sports, random events so effortlessly. For trading, find a good brokerage you can trust, and for investing, consider Vanguard where they aren't looking to make infinite money off you by offering everything.

Advice for other investors who want to get started or are just starting out?

If you want to go all in on trading, you should have 3-4 years of savings in which money is not an issue. For most, you shouldn't do this. My first few years of trading were very very tough, and it was mostly a result of not having enough money in the bank.

Most should do this part time and I have written about it here.