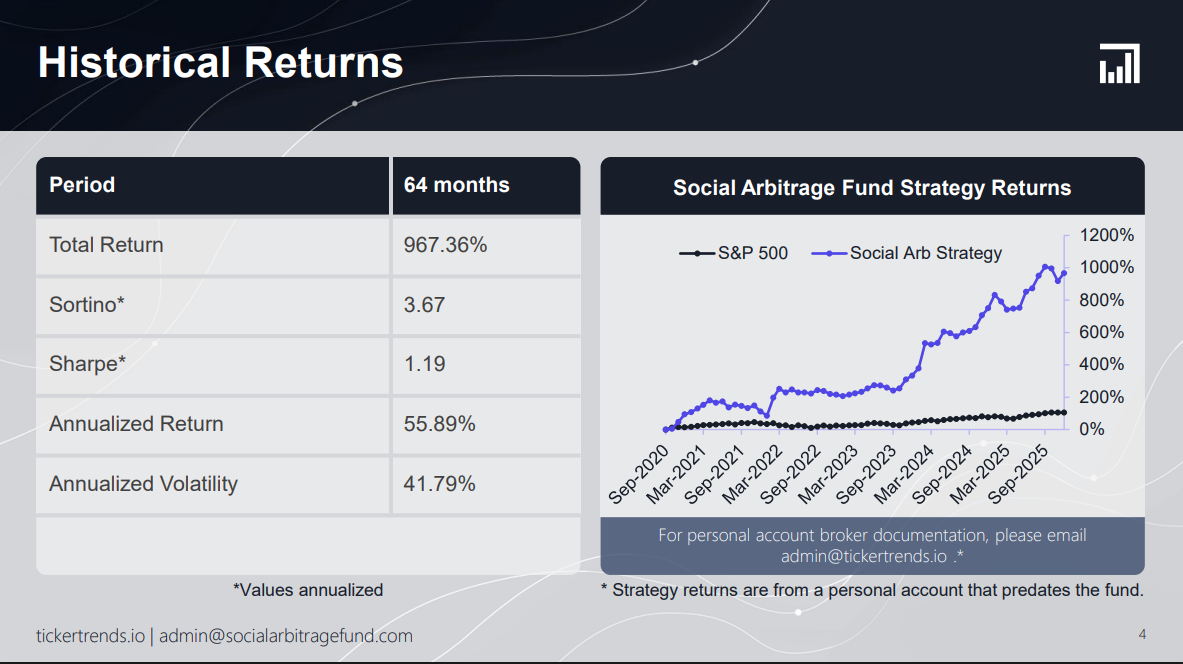

This Investing Fund Achieved 55% Annualized Returns Using Social Media Trends

Adrien Navarre

Social Arbitrage, TickerTrends.io

Hello! Who are you and what do you do today?

My name is Adrian Navarre. I'm the CEO and founder of Tickertrends. TickerTrends is a financial alternative data business and also an asset manager, a hedge fund. We also have the Social Arbitrage fund, which is a little bit separate from the TickerTrends software business, but generally connected in terms of the rough strategy. So I'm the CEO and founder of both businesses, TickerTrends Data and Social Arbitrage Fund. And I've been doing that now for just over three years in terms of working on it as a personal project and then eventually transforming into the full time business that it is today.

How would you describe your investing style today?

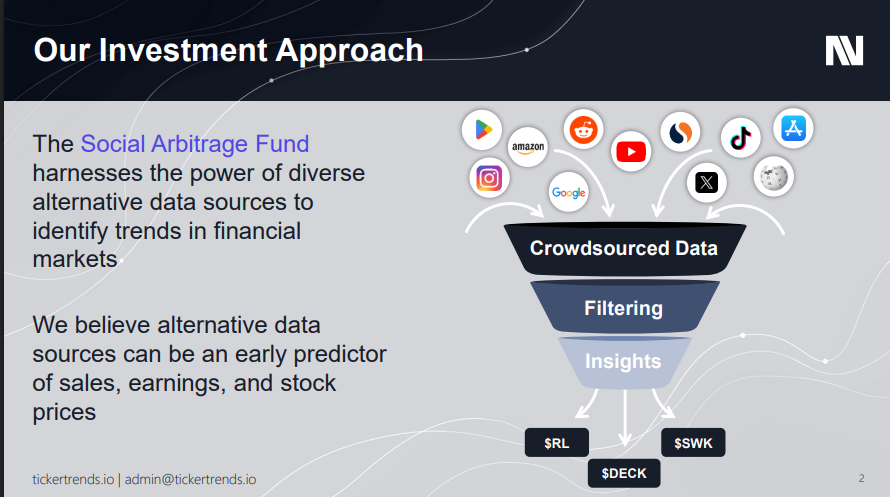

In terms of what we do on the investing side, we do what is called social arbitrage, which was generally coined by Chris Camillo and some of his crowd. Essentially what social arbitrage is, is looking at different social trends or different things happening with consumers and anticipating how that will impact various public businesses. It does get more technical once we go into how we apply that at the fund.

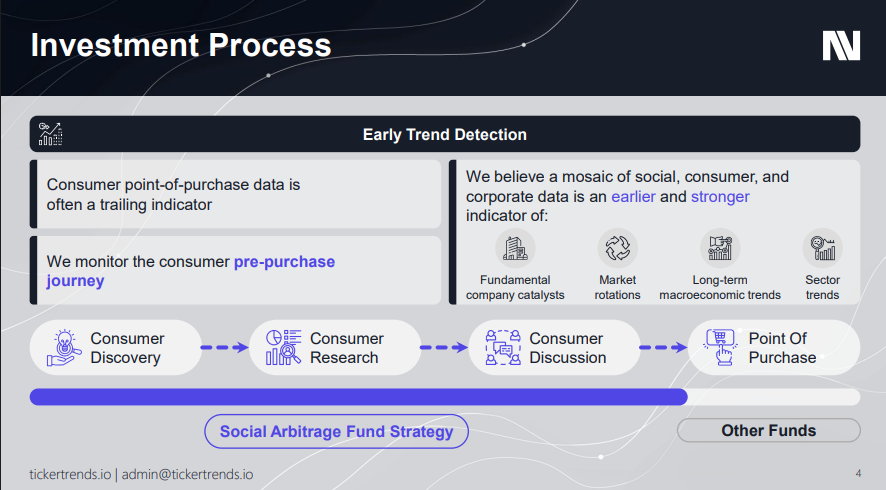

With social media and social trends, what tends to happen is there’s an anticipation in demand from when you look at social data to when that converts into something like credit card transaction data. That offers a lot of opportunities when trying to understand what consumers might be interested in purchasing and where they might spend their money a week from now, a couple months from now, or a year from now.

There are different ways to speculate on that in the market, which is what we do in the Social Arbitrage Fund, focusing on events that have never happened before — one-off events or impossible-to-model events — like a new product launch, a controversy, or a viral social event, and how that impacts the public business and its reported metrics.

I would say before this current approach to investing, I was much more of a long-term investor. Before I ever used any form of data in my personal investing, I was much more of a passive long-term investor, betting on a founder or company mission that I believed in, especially in technology, because that’s what my background was in.

Once I started to understand more about gaining an information edge and started to look at data, I realized I like to go down a lot of internet rabbit holes and understand different niche communities. That’s something I do even in my free time, consuming online content on YouTube or Reddit and understanding new products and what other consumers are interested in.

I found that when I could turn that into an informational edge in financial markets, it was very appealing to me, especially with the data sets I started to look at. That’s why this initially started as a personal project, because I was essentially managing my own portfolio. I was working a full-time job and didn’t have many expenses, so I would take my full paycheck and use it to pay an engineer to work on this software for my personal investing.

It very much started as a passion project, and I was doing these things already in my free time. Once I started to integrate data into my investing, my returns in my personal account were significantly stronger because I had something to prove or disprove the thesis I had on what was happening with a product or brand, and that became more sophisticated over time.

Walk us through your process for finding opportunities.

In terms of the general process, I am very much of the belief that as much as things can be discretionary, things can be quantified as much as possible. I think if a strategy can be truly articulated, then that will yield better results in the long run, especially as markets change and shift.

In terms of our general process, what we’ve done is build a much more sophisticated system around modeling by taking the data sets we collect. These are things we call consumer interest data sets, anything that indicates a consumer has heard about or is interested in a product or brand owned by public businesses. This includes web traffic, mobile app usage, search interest, and e-commerce performance, what people are searching for on platforms like Amazon or looking at on different websites. We collect all of this at scale.

We’ve created a system to take all of that data and transform it into a reported metric forecast, forecasting different reported metrics from the company. Once you have your forecasts, the next challenge is which ones do you act on and which ones do you not, and that comes down to understanding market expectations.

What’s often overlooked is that the consensus numbers that are publicly available are not really what market participants expect. People overlook market expectations, which is why you can have a business like Duolingo,just because a business is growing doesn’t mean the stock price is going to go up. Even if a business has surprise growth, it still doesn’t mean the stock price is going to go up.

Once we get to the KPI forecast, we have processes around understanding market expectations, what’s important to the market, and isolating and determining our confidence on different bets from there.

What are the biggest opportunities you see in the market today?

In terms of some of our recent interesting ideas that we’ve written about, we do some public research reports, and we have some paid notes, but most of them can be seen publicly.

One that we’ve covered a lot recently was Arc Raiders, which is owned by Nexon Co, a Japanese game development company. That one was very interesting and encapsulates some of the ideas of social arbitrage well. With a lot of new releases, specifically game releases, there are a couple of areas where there can be surprises in how a video game performs. Video games are very social oriented, with a network effect of people getting into the game and hearing about it. Very often games will launch and then drop off pretty quickly, but there are elements that can be interesting to speculate on: either way more sales than the market expects on launch, or a game having longer staying power than the market expects.

One that was similar was Marvel Rivals, produced by NetEase (NTES), which had longer staying power than the market expected. Arc Raiders is positioned very similarly. It had a massively successful launch, and even after the initial launch and traction, there’s been sustained interest of new people hearing about the game and continuing to play it. The concurrent user numbers have been way higher than anyone expected, and the performance this quarter (Q4 of 2025) will be about double what management guided in terms of unit sales of the Arc Raiders video game. That excess performance is a great example of an opportunity that checks a lot of the social arb boxes.

I always suggest to people that whatever you’re naturally interested in or whatever you do in your free time is probably something you could have an edge in with social arbitrage. If you like tennis, you’re buying tennis shoes and rackets and seeing what your friends are buying, which can give you an edge in trading the companies that produce those products, like Amer Sports (which owns Wilson) or Yonex. If you’re an avid video game player, you can do the same by understanding new game releases and speculating on the ones that have far excess performance compared to what the market expected.

Advice for other investors?

In terms of words of advice, something that always stuck with me is that even though TickerTrends, relative to some other data businesses, is still a small business and a smaller fund, I’ve met a lot of people over the past few years who have aspirations of starting a fund, a data business, or a startup.

A lot of the time, they are waiting for the right time. I’ll speak to analysts at a buy-side hedge fund who have been working there for 30 years, and they think that in another 10 years they’ll have enough experience or a big enough reputation to start their own fund.

People are too afraid to take that first step of starting the fund or the startup or the software business and taking the risk. That actually accelerates your learning process exponentially by going out and doing it yourself rather than waiting for the right time.

My general advice is to go out and start experimenting and failing. The faster you do that, and the more you fail, the better you’ll be later on. That’s the most important piece of advice I can give.

Favorite Tools and Media

Beyond the TickerTrends platform, there isn’t too much that I use outside of that. Maybe TradingView for price data and some basic financial data. Beyond that, for me it’s really about focusing on what I’m best at, or focusing on my informational edge, and most of that comes from the data that we track.

I try to care much less about anything outside of that data. Something else that’s important to be aware of is looking at platforms like X. I personally look at X to understand market narratives, but you could also look at any financial news publication or news feed to see what markets care about.

It’s very important to know what the market cares about and see if that overlaps with what your thesis is based on, rather than speculating on something when the market might care about a completely different factor. With AI, there’s so much that can happen with software companies, and even if their core software product is doing really well based on our data, it doesn’t necessarily mean the stock price will go up because the market might care about other factors outside of software performance.

So it’s about understanding market narratives, then viewing general price data and basic financial information, and most of it is based on the consumer interest data that we leverage on our platform.